Contents

Hopefully, our day trading definition has given you a basic understanding of what makes a day trader and what their activity is like in the financial markets. Now, we’ll take a deep dive into the pros and cons of being a day trader to help you decide if it’s an activity you’d like to take part in. Once day traders have budgeted both their money and their time then they can start conducting research and picking which stocks they will trade. Beginners should start small and trade only one or two stocks that they understand well. We have a look at what makes a great day trading stock and outline the best ones to trade right now. Schwab does not recommend the use of technical analysis as a sole means of investment research.

Investopedia does not include all offers available in the marketplace. Here are two simple guidelines that can be used to take profits when trading with trends. Sharekhan is here for you, with 22 years in business and thousands of happy customers later, we work relentlessly to get to the heart of what matters for your investment portfolio.

But by doing some research and watching your picks carefully, you may find success — and have a little fun at the same time. While some shares come under top gainers, others come under top losers. Instead of looking to someone else for advice on what the best stocks to day trade are, how about looking at your own trade performance.

Day trading stocks for beginners

Intraday trading may be a successful endeavour if done correctly. Time and sales data and Level 2 quotes are available for both stocks and options. The platform has a short location feature that indicates whether a stock is easy to borrow for short trading, would require extra effort to locate or is not available at all for borrowing. The Social Sentiment tool leverages data from Twitter and social media to capture financial market sentiment about a specific security.

All of the customer service agents at Cobra Trading are licensed professionals, many with substantial trading industry experience. We’ll cover the likes of breakout trading, trend following and counter-trend trading later in this guide. Stocks on the Rise What is the correct definition of stocks that are on the rise? More importantly, what is the average percentage gain for a stock on the… Results for these 6 scans will provide you more than enough as a new trader. However, if you can find the stock that is up on heavy volume and the board for the respective security on StockTwits is very active, you likely have a stock in play.

More https://en.forexbrokerslist.site/ indicates higher interest in a stock—both positive or negative. Often, an increase in the volume of a stock is indicative of price movement about to transpire. Day trading is a set of trading techniques where a trader buys and sells multiple times in the market over the course of a day to exploit volatility and trends in the asset’s intraday price. Trend analysis is a technique used in technical analysis that attempts to predict future stock price movements based on recently observed trend data.

Learn to trade

Forbes Advisor evaluated a total of 21 online brokerage platforms in order to help you choose the best online brokers for day trading. Speaking of risk management, most brokers will either be compatible with state-of-the-art trading software or offer their own proprietary trading platforms. Either way, there will be the option of setting stop-loss and take profit orders. This is important to manage your risk-reward for every trade and remove the emotion from your trading.

- This means day traders need to cast a wide net of knowledge and understand how everything – from interest rate hikes to trade wars – can impact different stocks.

- Day traders like stocks because they’re liquid, meaning they trade often and in high volume.

- Drawing in more trendlines may provide more signals and may also provide greater insight into the changing market dynamics.

- Here’s how to manage the substantial risks inherent to day trading.

- The SOES system ultimately led to trading facilitated by software instead of market makers via ECNs.

Cobra Trading has access to multiple locate sources including those of their clearing firm, Wedbush Securities, which has free HTB locates. Locate sources are the various securities lending firms where clients can locate and borrow hard to borrow shares. The DAS trading platform offered by Cobra Trading has a locate monitor window where you can check inventory from four different locate sources. Having multiple sources gives traders a better chance of being able to find the shares they may be targeting for selling short.

When you purchase liquid stocks, the cost is generally cheaper than other stocks. The advent of broadband Internet connections and responsive, intuitive online brokerage platforms has changed this dynamic. This strategy tries to ride the wave of a stock that’s moving, either up or down, perhaps to due to an earnings report or some other news. Traders will buy a rising stock or “fade” a falling one, anticipating that the momentum will continue.

Start Your Day Trading Journey with AvaTrade

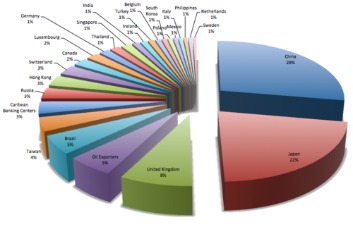

It has an average trading volume of 10 million shares, out of 177 million shares outstanding. When choosing stocks to day trade, look for stocks with high volume and high volatility. You want stocks whose price moves significantly, either by a percentage of the stock price or by dollar amount.

Share prices can be moved by a wide variety of external factors. Long-term, buy-and-hold investors typically do not experience the emotional swings that afflict most day traders — even when their holdings gain value. If you were to create and maintain a portfolio of low-cost exchange-traded funds instead of day trading, the odds of turning a profit over a long time horizon would be overwhelmingly in your favor.

Especially when you consider the significantly inflated tax rate assessed on https://forex-trend.net/-term trades , it’s fair to say that day trading is not worth the risk. It is estimated that more than 75% of stock trades in United States are generated by algorithmic trading or high-frequency trading. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Algorithmic trading is used by banks and hedge funds as well as retail traders. Retail traders can buy commercially available automated trading systems or develop their own automatic trading software. We have highlighted the most important filters to use on the stock screener– breakouts, gaps, volume, beta, ADR.

Below is a list of the best day trading stocks and ETFs to consider. The most consistently popular ETF among day traders is the SPDR S&P 500 ETF . This ETF has a high volume that allows you to trade smaller or larger position sizes based on volatility.

Best Online Brokers for Stock Trading

Indices are widely day traded since they have daily movement and are not subject to the same risk as individual stocks. A stock can go bankrupt, but an index tracks many stocks and therefore tends to be more stable than individual stocks. While indices may experience less volatility than some individual stocks, they still present opportunities that day traders can develop strategies around. The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders.

Alternatively, examine the https://topforexnews.org/ Volume Index for specific firms. For various reasons, trading volume often spikes before big upside or downside moves. During much of 2011 and 2012, the Eurozone crisis caused a prolonged, largely artificial volatility spike that overrode the rational instincts of even the most seasoned traders.

Note that $0 stock commissions are available on Interactive Brokers’s IBKR Lite platform for non-professional traders. With a possible recession still looming amid the ongoing bear market, investors are wondering which stocks to place their bets on. The analyst community expects volatility to continue in the near term… Day trading is not for the faint of heart, since you can lose money just as quickly as you make it.

Has its 20-day moving average broken above its 50-day moving average? A trader looking to short a stock might search for one trading below its 20-day moving average, and whose 20-day moving average is below its 50-day moving average. You might narrow the list further by looking for stocks that trade at least 200,000 shares a day. Hi Cory, I absolutely love your content and follow it daily and weekly. I’m on the West Coast and do I have to get up so early for the start of the market for effective day trading on some of the names that you point out that have high intraday volatility? Ideally I could start at perhaps 8 AM Pacific which would be 11 Eastern or something more reasonable.