Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download ClearTax App to file returns from your mobile phone. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. These borrowers are proof that poor women reliable borrowers and can start and successfully run a variety of small income-generating activities. People depend on SHGs for timely loans for a variety of purposes and at a reasonable interest rate.

So, people can deposit extra money and earn extra money, which is given on money already depositing in bank. • Deposits with Banks are also a form of money. To engage in loan activities, banks first need to assess the creditworthiness of potential borrowers. This involves evaluating a range of factors such as credit history, income, debt-to-income ratio, and collateral. Based on this assessment, the bank will determine whether to approve the loan, and if so, the amount and interest rate.

Theory, EduRev gives you an ample number of questions to practice What are the modern forms of money? Deposits with Banks are also a form of money. A person can deposit in the bank by opening an account on his/her name. People need only some money at a point of time.

Loan Activities of Banks

The modern forms of money- currency and deposits- are closely linked to the working of modern banking systems. Ans) The facility of cheques against demand deposits makes it possible to directly settle payment without the use of cash. Bank plays a very vital role as there would be no demand deposits and no payment by cheques against the demand deposit in absence of banking modern forms of currency system. Thus, it is clear that currency and deposits are closely linked to the working of the modern banking system. Which one of the following is the important characteristic of modern form of currency. It is made from precious metal It is made from thing of everyday use It is authorised by the commercial banks It is authorised by the Govrnment of the country.

Are the two forms of modern currency?

The two forms of modern currency are paper notes and coins. What are the two forms of modern currency?

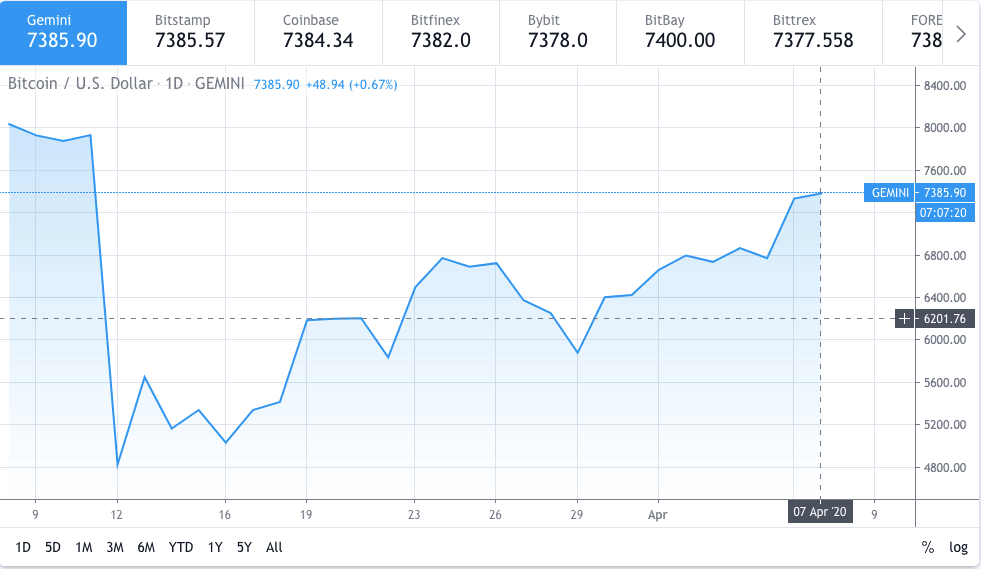

It’s a paper that makes the bank transfer money from one person’s account to another. In the 21st century, the virtual currency is a new form of currency which has entered the vocabulary. Virtual currencies, traded and stored in an electronic form, such as the bitcoins or the litcoins, do not have physical existence or government support. Impact of SVB’s Fallout on DM and EM currencies! With weakening EM currencies, the Rupee is also bound to weaken. Impact of SVB’s fallout on DM and EM currencies!

Notes of Money and Credit Class 10

As time progressed, trade increased and a global market was created. With the global market came the need for a more convenient medium of exchange. Thus was born the modern forms of money – paper notes and coins.

In India, the rupee is widely accepted as a medium of exchange because of the authentication of the Reserve Bank of India . RBI plays an essential role in printing currencies. There is no other authority that has the power to issue and circulate the currency. It is the law that legalizes the use of rupee as a medium of exchange anywhere in India.

Some other currencies are the Canadian Dollar, Chinese Yuan, Indian Rupee, Brazilian Real, Ruble, Turkish Lira, etc. A currency comes from the Latin word “currere,” which means “to run” or “to flow.” The word “money” comes from the Latin word “monere,” which means “to warn.” Explain with an example how the terms of credit can be unfavourable for the small farmer. The information on this website is collected from various sources and we cannot be held responsible for its accuracy.

Each of these products has different terms and interest rates, and borrowers can choose the product that best suits their needs. Banks engage in loan activities to provide financing to individuals and businesses in need of capital. Loans are one of the primary sources of revenue for banks, and the interest charged on loans is a key way in which banks make money. The formal sector still meets only about half of the total credit needs of the rural people and the remaining credit needs are met from informal sources. The first choice is to set a fixed exchange rate.

• Facilities of banks are not available in all rural areas. Corect option is D) In the ancient to medieval times, popular currency forms used were gold coins, silver coins, copper coins etc. In modern times paper notes and coins are used as the medium of exchange. In the Informal sector, the rate of interest is supervised by moneylenders, traders, employers who are provided money. The rate of interest is varying from person to person. There is no organization for supervising loan in informal sector.

Still, fixed exchange rates have caused many currency crises in the past few decades. This can happen, for example, when the central bank cannot maintain the peg in the face of market factors. China may have come up with using paper as money as early as 1000 BC, but it took a long time for people to accept paper in exchange for something of real value.

Deposits with Banks

Credit is an agreement in which is created when a person gives money and goods to the needy person with the promise of to repay that with some rate of interest. • There are two types of sources of credit in an economy. • Credit is an agreement in which is created when a person gives money and goods to the needy person with the promise of to repay that with some rate of interest. Money’s use has simplified and enhanced trade and commerce as it allows individuals to exchange goods and services without the need for direct bartering or trading. Save taxes with ClearTax by investing in tax saving mutual funds online.

What is the example of modern form of money?

Modern forms of money include currency — paper notes and coins. Currency is accepted as a medium of exchange as it is authorised by the government of the country. In India, the Reserve Bank of India issues currency notes on behalf of the central government.

Money is called a medium of exchange since money acts as an intermediate in the exchange process. You can bring as much foreign money as you want into India. Fiat currencies are used by most of the world’s major economies today. Since they are not tied to anything real, governments can make new money when they have trouble paying their bills. This gives more options for dealing with problems, making it possible to spend too much.

Quick links for Class 10 exam

Paper notes Demand deposits Silver coins None of the above Silver coins 21. Solutions for What are the modern forms of money? Before the introduction of coins, a few precious metals were used as money.

The government issues modern money, which comprises banknotes and coins used for exchange. In this article, we will explore the fascinating world of money and credit in Class 10. Money and credit play a crucial role in our daily lives, and understanding their dynamics is essential for making informed financial decisions.

• Collateral is an asset of the borrowers which is given to the lenders as security for the specified period. A lender can use the assets which are held by him as security until the amount of loan is repaid. The lender has right to sell the assets or collateral when the borrower fails to repay the amount of loan in a specified period. The terms of credit include the interest rate, collateral and documentation requirements, and repayment method. These terms can differ based on the lender and borrower’s nature.

- • Money is an item which is used as a medium of exchange.

- In case of any non-repayment by the one member is followed by the other member of the organisation.

- Money in the form of currency has existed for at least 3000 years.

- Save taxes with ClearTax by investing in tax saving mutual funds online.

Modern forms of money are linked to the banking system. The lender specifies an interest rate in every loan agreement, which the borrower must pay along with the repayment of the principal. Additionally, lenders require collateral against loans. Once the loan is approved, the bank will disburse the funds to the borrower, who will be required to make regular payments over a set period of time. These payments will typically include both principal and interest.

How do banks play an important role in the economy of India? It is a term that is used in reference to the hard plastic cards which are used in place of actual banknotes. Bank also offers cheque facilities to their depositors for settlement of their payments without the use of cash. Banks not only provide security to their money but also give them interest on their deposits.

So, the poor are dependent on informal sector for borrowing loan. The poor have to pay a high rate of interest to the moneylenders. It is difficult to borrow loan from the bank. Because of the absence of the collateral and documents. And documents and collateral are required for a bank loan. Informal lenders like, moneylenders are often willing to give a loan without collateral because they personally knew the borrowers.

What is the example of modern form of money?

Modern forms of money include currency — paper notes and coins. Currency is accepted as a medium of exchange as it is authorised by the government of the country. In India, the Reserve Bank of India issues currency notes on behalf of the central government.